What's so bad about debt?

An estimated 70-80% of Americans are living paycheck-to-paycheck. That means 7 or 8 out of every 10 people you know aren’t prepared for a basic emergency. Money disputes and financial stress are the number one cause of divorce in the United States. Living debt-free is about peace of mind.

Paying off your debt gives you the freedom and power to make choices about your own life and positively impact the lives of others. It takes money to accomplish your goals and live your dreams. It takes money to feed and house people. With more money in the bank, you can make more choices, be more generous, and leave a legacy. Why do you want to be debt free?

When you stop being slave to the lender, your income becomes a tool to create wealth. When you start living a life of your choice and your own design, you start being in a position to create the world you want to live in.

Debt is a slippery slope, and it’s usually not about the money. It’s about mindset, choices, behavior and habits. Those can be changed. Getting out of debt and building wealth is about living an easier, richer, more fulfilling, and more generous life.

Why should I make this a priority?

How would your life be different if you were free from financial responsibilities to other people, and were in a position to make more conscious and powerful decisions with your money? Imagine what you could do with all that money that’s currently getting sliced off your paycheck every month.

Getting out of debt is a priority because being free from bondage feels really good. Being free from payments feels good. Having money in the bank so that emergencies become mere inconveniences feels good. Having fewer financial obligations and more choices puts you in control of your life. Being in a position to be generous, and help other people on their path, is fulfilling and admirable.

The process of opening your life to the blessings of abundance is a life-changing journey. In order to get out of debt, you will have to change who you are and how you think. Change may be challenging, but the things in life worth having come with some level of sacrifice and adventure.

Debt is negative wealth. One of the most positive things you can do for yourself is to ditch the risks and stress associated with debt…ASAP.

How do I know if this is right for me?

Are you tired of living the way you’ve been living? Do you want to change your relationship to money and improve your finances immediately? Then you may be a good fit for debt coaching.

I know from experience that paying off debt instead of buying something you really want is a bummer. That’s why we stay in debt! It can feel like you’re sending money to a black hole when you would rather spend the money on something that feels better in the short-term, and gives you an immediate lift. I know what it’s like to get out, and then fall right back into owing people money again. I know first-hand the temptation of fueling a business with a credit card. I know how demoralizing and frustrating it can feel to not be able to have the things you want in life.

I also know how great it can feel to start living with financial clarity, intention and focus. I know how great it feels to cut up a credit card and never use it again. Do you know how fabulous it feels to make large purchases, or take care of emergencies, with cash? Have you seen an entire house be purchased with a check? Living life on your own terms is power.

Working with a coach puts extra wind in your sails to help you get where you want to go, faster.

A coach is…

- Your ally who wants to see you win.

- Someone who can help you get motivated and organized.

- An accountability partner to help you stay on track and accomplish your goals as quickly as possible.

- There to support and encourage you when things get tough.

- A partner who can help you make the changes you need to make in order to move ahead, succeed where you were failing, and live the life you really want—a life of your design.

Transforming and upgrading your life is a personal, private and sacred process. No one can do it for you. If you’re ready to challenge yourself to transform and expand, great!

Am I a good candidate for debt coaching?

Credit card debt. School loans. Car loans. Personal loans. Business loans. Tax debt.

You may benefit from some objective, outside support from a debt coach if…

- You believe you have the power to change your life and take responsibility for solving your own problems.

- You’re tired of being broke, want more for yourself, and are ready for something different in your financial life.

- You feel like there is a disconnect between who you are inside, your potential, and the way things are actually going for you.

- You want to get into alignment, so your reality is more like your vision.

You need to be ready to get a little uncomfortable at first, so you can start to shift and feel the relief and exhilaration that comes with changing. If you have gotten to the point of being completely fed up with your situation, then it’s time to try some different mindsets, beliefs and behaviors.

Can you imagine what it would be like to have money in the bank, and freedom from lenders, bills and bill collectors? Do you want to get on the road to building true wealth instead of pretending to have it? Let’s team up on the project of transforming your finances.

How did you get interested in helping people get out of debt?

I have often been called on to help people through significant challenges, and crisis coaching comes naturally to me. My experience helping people who are struggling with debt started when I worked as a bankruptcy law assistant.

Is debt consolidation a good idea?

While consolidating debt might be a sound option in some situations, it can also lead to more problems so you need to consider it carefully…and not just from a numbers standpoint.

Debt consolidation sometimes means lower payments at a higher interest rate, being in debt for a longer period of time and spending more money.

The thing is—debt isn’t about math, it’s about behavior. Financial problems are emotional, psychological and emotional. Debt consolidation can actually get you deeper into debt if it frees up some of your money and you feel more abundance but you haven’t changed your mindset, relationship dynamics or habits. What you need is a comprehensive strategy for living debt-free that considers your individual situation, including your spending habits and untapped earning potential.

How about breaking free from the shackles of owing people money instead of just moving your debt around, and quite possibly taking on more? A financial coach with a debt-free, legacy-building mindset can help you figure out the fastest, most effective way to pay off your creditors for good. A financial coach can walk with you while you transform your life, starting with your relationship to money.

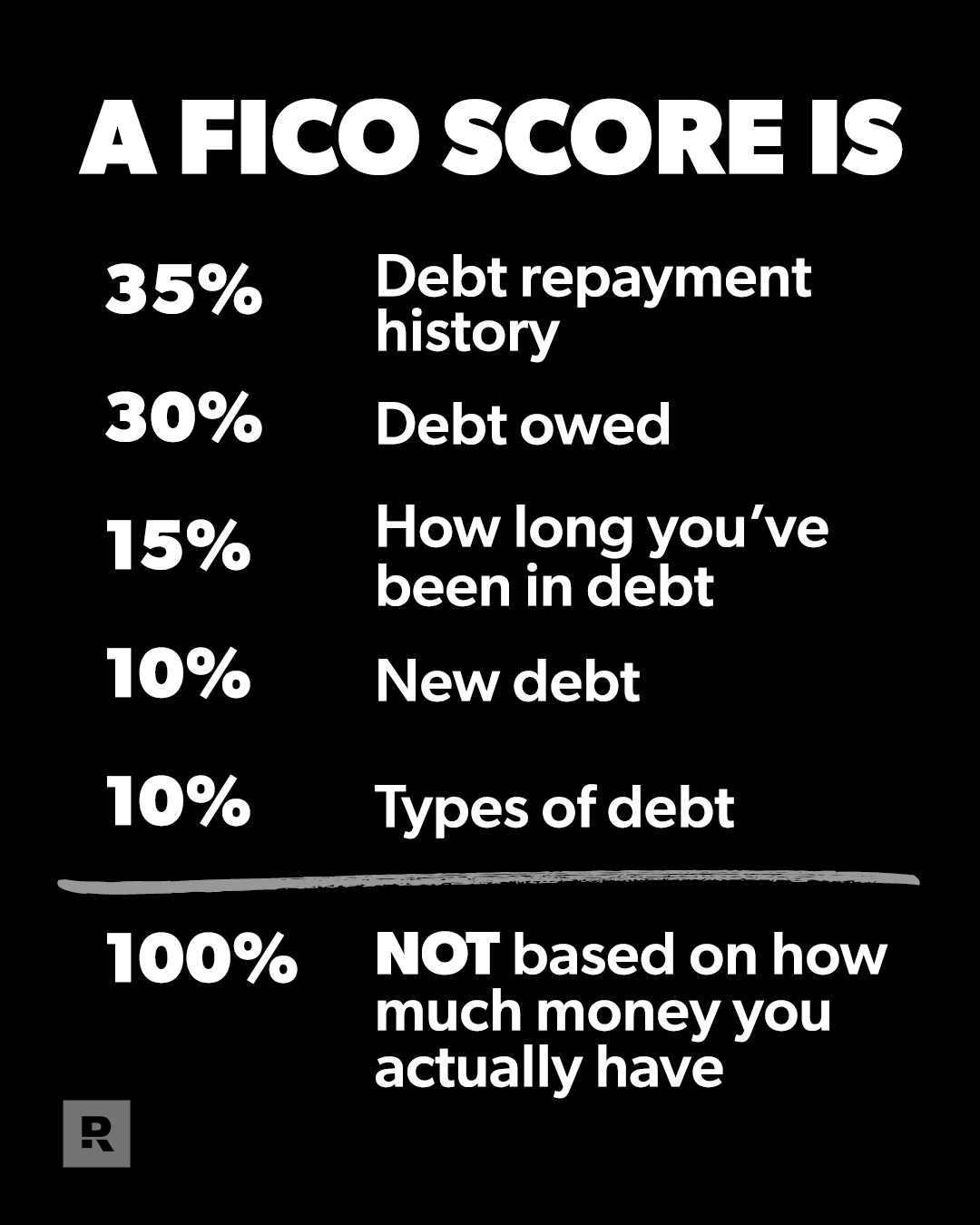

What about my credit score?

A credit score isn’t an indicator of your ability to manage wealth. It’s a reflection of how willing you are to play the game of owing people money.

You have to decide if you want to live your life free from the bondage of creditors or not. It’s up to you. When you focus on your net worth instead of your credit score, your credit score becomes far less important. Buying a house, for example, can be done through manual underwriting or you can pay cash.

You can always go back into debt if you don’t like being debt free!

How can broke people afford debt coaching?

Being broke is expensive, and the first step to building wealth is getting out of debt.

Broke people still find a way to have money for the things they want: interest on a brand new car loan, Netflix, a $150+/mo. cable bill, restaurants, vacations, a phone upgrade… I know how it goes. Desires have a way of becoming “needs” when we get good at justifying our lifestyle choices. If you’re like me, you can justify buying just about anything you want, and justify it well. What is it worth to you to stop living paycheck-to-paycheck, stop being so stressed out about money, finally gain control over your finances and start building wealth? When you choose debt coaching, you’re investing in yourself and a better life.

The value a debt coach provides is much more than what we charge. Add up all the interest, penalties, banking and late fees you’ve paid in the last year (or five). What could you have spent that money on, instead? Who could you help? What could you do with your credit card or school loan payments if you didn’t have to send that money out every month? For one thing, you could have more choice and ease in your life instead of being stressed out about money. You would also be in a position to give generously, and invest that money to build a legacy of wealth.

When I worked in a bankruptcy law office, it warmed my heart to see people’s stress melt away while they sat in our office. It was frustrating, though, that I couldn’t help them more. Were they going to go home and change their habits and transform their lives? I would never know. I wished we could have helped them sooner.

As Dave Ramsey says, “There is dignity in choice.” It’s worth choosing life-altering knowledge and support over objects and experiences that—let’s face it—aren’t really making you feel rich. When you choose to dig yourself out of debt instead of buying another object or experience you haven’t actually earned yet, in order to make yourself look rich when you aren’t, you’re getting on the path of building wealth. Debt is negative wealth, and owing people money is literally a drag. The first step to actually being wealthy—instead of trying to look and feel rich—is to stop being a slave to the lender. Stop dragging debt around with you, and choose to get free.

What is it worth to turn your finances around and get into the black…quickly? The focus, support, knowledge and accountability coaching offers saves you time and money.

Like anything worth having, building wealth is a choice and it has a price. Being at peace with money is worth it.

MOTIVATION

FAQ

STRATEGY

COACHING

ABOUT

CONTACT